Products & Services

Motor

汽車保險

There are two types of cover for both private motor vehicle and commercial vehicle.

(A) Comprehensive coverage

- Loss of or damage to your motor car and/or its accessories or spare parts

- Legal liability for causing third party’s death and/or bodily injury up to HK$100,000,000

- Legal liability for causing third party’s property damage

(B) Third Party coverage

- Legal liability for causing third party’s death and/or bodily injury up to HK$100,000,000

- Legal liability for causing third party’s property damage

For private vehicle, comprehensive coverage even comes with the below additional benefits (vary with different insurers)

- Claims recovery service

- Emergency towing service

- No claim discount (NCD) protection

- New for old replacement vehicle

- Windscreen replacement

- 24-hour assistance hotline

Home

家居保險

Home insurance covers

- Accidental loss of or damage to household contents, personal belongings caused by fire, burglary, typhoon, earthquake, flood, bursting of water pipes and many other mishaps

- Legal liability towards third parties bodily injury or property damage caused by you or your family members’ negligence.

Additional coverages including but not limited to

- Money and unauthorized use of credit cards

- Household removal

- Alternative accommodation

- Frozen food and drinks

- Domestic helper’s personal effects

- Worldwide personal belongings

(may vary with different insurers)

Travel

旅遊保險

Travel Insurance normally covers

- Medical and related expenses

- Worldwide emergency assistance service

- Personal accident

- Baggage and personal effects

- Baggage delay

- Personal money and travel documents

- Personal liability

- Travel inconvenience

- Loss of deposit or cancellation of trip

- Trip curtailment

- Rental vehicle excess

Fire

火險

Fire cover accidental loss of or damage to your property insured caused by fire, lightning or explosion of boilers or gas used for domestic purposes only, or by any extra peril below

- Aircraft

- Bush Fire

- Earthquake

- Explosion

- Impact by road vehicle

- Riot and strike

- Malicious damage

- Sprinkler leakage

- Typhoon, windstorm and flood

- Bursting or overflowing of water tanks, apparatus or pipes

- Landslide & subsidence

Property all risks provides cover against accidental loss of or damage to property caused by all hazards not excluded from the policy.

Business package

商業綜合保險

Provides comprehensive cover to business owners including

- All risks cover to office/shop contents

- Business Interruption

- Money Insurance

- Fidelity Guarantee

- Public Liability

- Employees’ Compensation Insurance

Domestic helper

家傭保險

Domestic Helper normally covers

- Employees’ Compensation Insurance

- Clinical Expenses

- Surgical and Hospitalization Expenses

- Dental Expenses

- Personal Accident Benefits

- Loss of Services Cash Allowances

- Repatriation Expenses

- Replacement Helper Expenses

- Fidelity Guarantee

Contractors All Risks

建築全險

(A) Material damage

(1) Provide “All Risks” cover for loss of or damage which have not excluded from the policy to your contract works or material caused by fire, water, burglary or explosion etc. during the working period.

(B) Liabilities to third parties

Indemnify you in respect of all sums which you shall become legally liable to pay for

(1) Accidental death, bodily injury, illness or disease suffered by any person arising out of the performance of the insured contract.

(2) Accidental loss or damage to third party property arising out of the performance of the insured contract.

Employee's Compensation

勞工保險

According to the Employees’ Compensation Ordinance in Hong Kong, the employer shall be responsible for the compensation payable under both the Ordinance and Common Law for the injury or death of their employees in the course of employment. The insurance to cover employers’ liability in the event that their staff suffers an injury or illness during the normal course of their work.

- Death

- Permanent Total / Partial Incapacity

- Temporary Incapacity

- Occupational Disease

- Medical Expenses

Public Liability Insurance

公眾責任保險

Public Liability Insurance provides indemnity to the Insured against all sums which the Insured shall become legally liable to pay for compensation in respect of accidental death of or bodily injury to any person or accidental loss of or damage to property arising from the Insured’s business caused by your negligence.

Marine Cargo Insurance

貨運保險

Marine Cargo Insurance covers the risk of loss and damage to your insured cargo caused by any un-predictable risk not excluded from the policy.

Professional Liability Insurance

專業責任保險

Professional Liability Insurance protects you from legal liabilities that may be caused by negligence, omission or wrongdoing when you provide professional services.

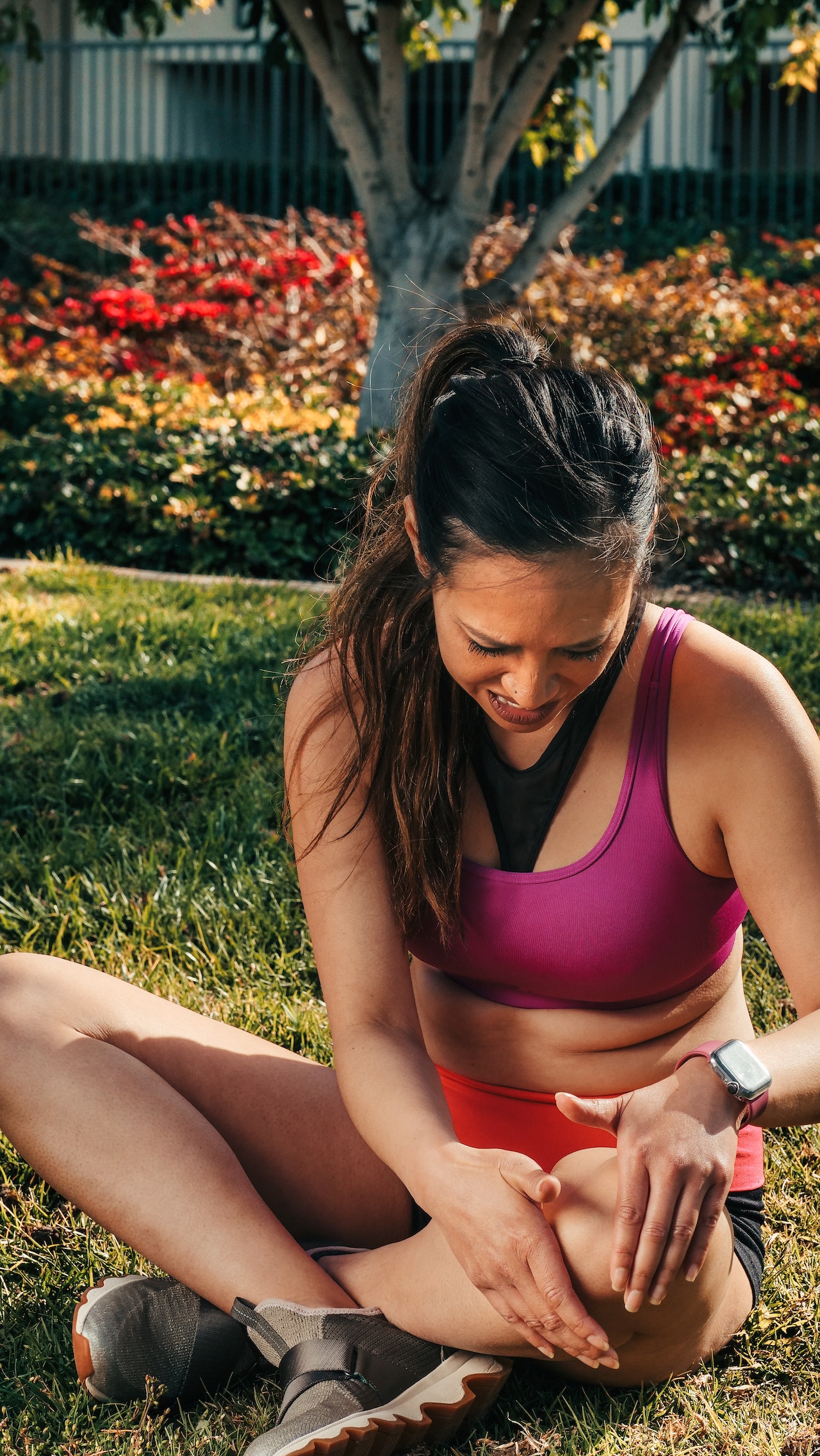

Personal Accident Insurance

個人意外保險

Personal Accident Insurance provides multiple protections including accidental death, total permanent disability and medical expenses caused by incidents. Loss of income coverage could be extended to policy.